Sarah Palin thanks God and Supreme Court for healthcare ruling

SourceSarah Palin thanks God and Supreme Court for healthcare ruling

By Robin Abcarian

June 28, 2012, 1:34 p.m.

Sarah Palin thanked the Supreme Court and the Almighty this morning after the high court ruled in favor of President Obama’s healthcare reform law.

Why the contrarian reaction from a conservative who has railed against the law, and even pushed the long-debunked claim that bureaucratic “death panels” will make life-and-death decisions about the elderly and the disabled?

The former Alaska governor is making an entirely political calculation that the survival of the healthcare reform law will spell doom for Democrats in November.

“Thank you, SCOTUS,” wrote Palin on her Facebook page. “This Obamacare ruling fires up the troops as America’s eyes are opened. Thank God.”

Palin, who has not held office for three years but regularly appears on Fox News as a political commentator and is a favorite of tea party groups, seized on the Supreme Court’s decision as proof that the Obama administration has curtailed personal liberty. Like many Obamacare opponents, she focused on the court’s rationale for upholding the law as a constitutional exercise of Congress’ power to tax. That, she claimed, proves the president has broken his campaign promises not to raise taxes on the middle class.

“Obama promised the American people this wasn’t a tax and that he’d never raise taxes on anyone making less than $250,000,” wrote Palin. “We now see that this is the largest tax increase in history. It will slam every business owner and every one of the 50% of Americans who currently pay their taxes. The other 50% are being deceived if they think they’re going to get a free ride – because Medicaid is broke. Recipients of Obama’s 'free health care' will have fewer choices and less accessibility. Trust me – this much more expensive health care WILL be rationed; to claim otherwise defies all economic and common sense.”

Actually, the law calls for a tax penalty only on those who choose that option by refusing to buy insurance. The tax penalty would not apply to those who cannot afford health insurance and will not be applied to anyone who purchases health insurance. Only those who can afford health insurance and refuse to buy it are subject to the tax penalty, the rationale being that those people will inevitably need healthcare and those costs otherwise would be passed on to the insured in the form of higher premiums. Obama has argued that people who behave responsibly should not be forced to pay the healthcare bills of those who do not.

Still, Palin called upon Congress to “act immediately to repeal this terrible new tax on the American people.... We the People did not ask for this tax, we do not want this tax, and we can’t afford this tax. This is not an answer to America’s health care challenges.”

Palin did not offer any solutions to the problem of rising healthcare costs, nor any ideas about how to provide health insurance for the millions of Americans who lack it.

Instead, as she often does, she employed the rhetoric of battle. “We will not retreat on this,” she wrote. “A newly elected legislative branch is key to defending our Republic and fundamentally restoring all that is good in America.”

Echoing the sentiment of presumptive Republican presidential nominee Mitt Romney earlier in the day, she urged supporters to take their frustration to the ballot box.

“It’s time, again, for patriotic Americans to rise up to protest this obvious infringement on our economic and personal freedom,” wrote Palin. “November is just around the corner. Today, the Supreme Court issued their ruling on Obamacare. In November, We the People will issue ours.”

robin.abcarian@latimes.com

The sad thing is that it seems like all the politicians are crooks and

will says anything to get elected.

And of course Mitt Romney and President Obama are both just as

guilty of that.

Mitt Romney says healthcare plan's individual mandate is a tax

By Mitchell Landsberg, Los Angeles Times

July 4, 2012, 5:39 p.m.

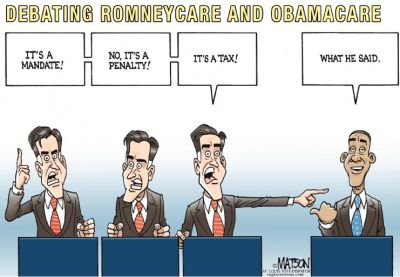

WOLFEBORO, N.H. — Contradicting one of his senior advisors, Mitt Romney said Wednesday that the individual mandate in President Obama's healthcare plan is a tax, and stands as evidence that Obama has broken a promise not to raise taxes on the middle class.

On a holiday otherwise light on political skirmishing, Romney effectively overruled remarks from his campaign spokesman, Eric Fehrnstrom. It was the second time in recent months that he has undertaken damage control after controversial remarks by Fehrnstrom.

The first of those involved Fehrnstrom's instantly infamous Etch-A-Sketch statement, in which he said that Romney's rightward tilt during the primary campaign would be wiped clean once he secured the Republican nomination.

Then, on Monday, Fehrnstrom gave conservatives more cause for consternation when he said that Romney agreed with Obama that the individual mandate was a penalty, not a tax — despite the Supreme Court ruling that it was constitutional precisely because it was a tax.

That left Romney with an unpleasant choice: Give up a potentially golden opportunity to attack Obama for raising taxes or contradict his own campaign spokesman. As with the Etch-A-Sketch remark, he chose the latter.

Asked by CBS correspondent Jan Crawford why he thought the mandate was not a tax, Romney replied: "Well, the Supreme Court has the final word, and their final word is that Obamacare is a tax. So it's a tax."

He added: "They decided it was constitutional. So it is a tax and it's constitutional. That's the final word — that's what it is. Now, I agreed with the dissent. I would have taken a different course, but the dissent wasn't the majority. The majority has rule and their rule is final. It is a tax."

The high court upheld the Obama healthcare law by a 5-4 margin last week, with Justice Antonin Scalia expressing the losing position — that the law was unconstitutional — in a scathing dissent.

That prompted Fehrnstrom's comment that Romney "agreed with the dissent, which was written by Justice Scalia, and the dissent clearly stated that the mandate was not a tax."

In his remarks Wednesday, Romney drew a distinction between a similar provision that he put in place in Massachusetts and the Obama mandate. Both laws require people who don't have health insurance to buy it or face a penalty.

States, he said, "have the power to put in place mandates. They don't need to require them to be called taxes in order for them to be constitutional."

Romney also took the opportunity to go on the offensive against Obama, saying that, in light of the Supreme Court ruling, "the American people know that President Obama has broken the pledge he made. He said he wouldn't raise taxes on middle-income Americans."

The Obama campaign shot back, ridiculing Romney for what it portrayed as a hopelessly muddled series of statements.

"Romney contradicted his own campaign, and himself," a campaign statement said. "First, he threw his top aide Eric Fehrnstrom under the bus.... Second, he contradicted himself by saying his own Massachusetts mandate wasn't a tax — but, Romney has called the individual mandate he implemented in Massachusetts a tax many times before. Glad we cleared all that up."

The back-and-forth came on a day when both candidates were observing Independence Day and largely taking a break from the political fray.

Obama led a naturalization ceremony for active-duty military troops at the White House, where he also attended a picnic. Romney took part in holiday festivities near his New Hampshire vacation home.

The naturalization ceremony was the third such event led by Obama.

"This is one of my favorite things to do," the president said in a speech to the new citizens. "It brings me great joy and inspiration because it reminds us we are a country that is bound together not simply by ethnicity and bloodlines, but by fidelity to a set of ideas."

Obama also took the opportunity to urge Congress to pass immigration reform, after the failure of the Dream Act in the Senate and his administration's recent declaration that it would no longer deport young illegal immigrants who crossed the border as children, provided they meet certain criteria.

"The lesson of these 236 years is clear — immigration makes America stronger. It positions America to lead in the 21st century. These young men and women are testaments to that," he said of the 25 families gathered for the proceedings.

Romney marched in a parade through the lakeside town of Wolfeboro, where he is spending the week with about 30 members of his immediate family — "a bevy of Romneys," as he put it. He was joined by Sen. Kelly Ayotte (R-N.H.).

After the parade, he delivered a speech that set aside, for the moment, the bruising rhetoric of the presidential campaign.

Talking about patriotism and shared values, Romney went so far as to celebrate the presence of Obama supporters in the parade, and quickly silenced his own backers who booed at their mention.

"You know what?" Romney said from the back of a pickup truck overlooking a blue-green vista of Lake Winnipesaukee and distant mountains. "They were courteous and respectful, and said, 'Good luck to you,' and 'Happy Fourth of July.'"

mitchell.landsberg@latimes.com

Morgan Little in the Washington bureau contributed to this report.

FACT CHECK: Romney, Obama both misstate facts about new law

by Ricardo Alonso-Zaldivar - Jul. 4, 2012 08:02 PM

Associated Press

WASHINGTON - President Barack Obama promises nothing will change for people who like their health coverage, except that it will become more affordable. But the facts don't back him up.

Mitt Romney groundlessly calls the health-care law a slayer of jobs certain to deepen the national debt.

Welcome to the health-care debate 2.0. As the claims fly, buyer beware.

After the Supreme Court upheld the law last week, Obama stepped forward to tell Americans what good will come from it. Romney was quick to lay out the harm. But some of the evidence they gave to the court of public opinion was suspect.

A look at their claims and how they compare with the facts:

Check 1: The insured

Obama: "If you're one of the more than 250 million Americans who already have health insurance, you will keep your health insurance. This law will only make it more secure and more affordable."

Romney: "Obamacare also means that for up to 20 million Americans, they will lose the insurance they currently have, the insurance that they like and they want to keep."

The facts: Nothing in the law ensures that people happy with their policies now can keep them. Employers will continue to have the right to modify coverage or even drop it, and some are expected to do so as more insurance alternatives become available to the population under the law. Nor is there any guarantee that coverage will become cheaper, despite the subsidies many people will get.

Americans may well end up feeling more secure about their ability to obtain and keep coverage once insurance companies can no longer deny, terminate or charge more for coverage for those in poor health. But particular health-insurance plans will have no guarantee of ironclad security. Much can change, including the cost.

The non-partisan Congressional Budget Office has estimated that the number of workers getting employer-based coverage could drop by several million, as some workers choose new plans in the marketplace or as employers drop coverage altogether. Companies with more than 50 workers would have to pay a fine for terminating insurance, but in some cases that would be cost-effective for them.

Obama's soothing words for those who are content with their current coverage have been heard before, rendered with different degrees of accuracy. He's said nothing in the law requires people to change their plans, true enough. But the law does not guarantee the status quo for anyone, either.

So where does Romney come up with 20 million at risk of losing their current plans?

He does so by going with the worst-case scenario in the budget office's analysis. Researchers thought it most likely that employer coverage would decline by 3 million to 5 million, but the range of possibilities was broad: It could go up by as much as 3 million or down by as much as 20 million.

Check 2: Implications for the national debt

Romney: After saying the new law cuts Medicare by $500 billion and raises taxes by a like amount, he adds: "And even with those cuts and tax increases, Obamacare adds trillions to our deficits and to our national debt and pushes those obligations onto coming generations."

The facts: In its most recent complete estimate, in March 2011, the Congressional Budget Office said the new health-care law would actually reduce the federal budget deficit by $210 billion over the next 10 years. In the following decade, the law would continue to reduce deficits by about one-half of 1 percent of the nation's gross domestic product, the office said.

The congressional budget scorekeepers acknowledged their projections are "quite uncertain" because of the complexity of the issue and the assumptions involved, which include the assumption that all aspects of the law are implemented as written. But the CBO assessment offers no backup for Romney's claim that the law "adds trillions to our deficits."

Check 3: Insurance rebates

Obama: "And by this August, nearly 13 million of you will receive a rebate from your insurance company because it spent too much on things like administrative costs and CEO bonuses and not enough on your health care."

The facts: Rebates are coming, but not nearly that many Americans are likely to get those checks, and for many of those who do, the amount will be decidedly modest.

The government acknowledges it does not know how many households will see rebates in August from a provision of the law that makes insurance companies give back excess money spent on overhead instead of health-care delivery. Altogether, the rebates that go out will benefit nearly 13 million people. But most of the benefit will be indirect, going to employers, because they cover most of the cost of insurance provided in the workplace.

Employers can plow all the rebate money, including the workers' share, back into the company's health plan or pass along part of it.

The government says about 4 million people who are due rebates live in households that purchased coverage directly from an insurance company, not through an employer, and experts say those households are the most likely to get a rebate check directly.

The government says the rebates have an average value of $151 per household. But employers, who typically pay 70 to 80 percent of premiums, are likely to get most of that.

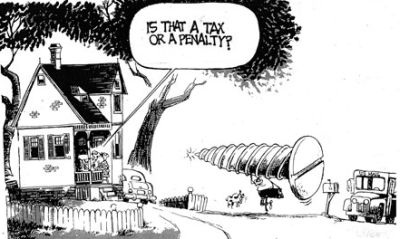

Check 4: Tax increases and penalties

Romney: "Obamacare raises taxes on the American people by approximately $500 billion."

The facts: The tax increases fall heavily on upper-income people, health-insurance companies, drugmakers and medical-device manufacturers.

People who fail to obtain health insurance as required by the law will face a tax penalty, although that's expected to hit relatively few because the vast majority of Americans have insurance, and many who don't will end up getting it. Also, a 10 percent tax has been imposed on tanning-bed use as part of the health-care law. There are no other across-the-board tax increases in the law, although some tax benefits such as flexible savings accounts are scaled back. Of course, higher taxes on businesses can be passed on to the consumer in the form of higher prices.

Individuals making more than $200,000 and couples making more than $250,000 will pay 0.9 percent more in Medicare payroll tax and a 3.8 percent tax on investments. As well, a tax on high-value insurance plans starts in 2018.

Check 5: Adults younger than 26

Obama: "Because of the Affordable Care Act, young adults under the age of 26 are able to stay on their parents' health-care plans, a provision that's already helped 6 million young Americans."

The facts: Obama is overstating this benefit of his health law, and his own administration knows better. The Department of Health and Human Services, in a June 19 news release, said 3.1 million young adults would be uninsured were it not for the new law. Obama's number comes from a June 8 survey by the Commonwealth Fund, a health-policy foundation. It said 6.6 million young adults joined or stayed on their parents' health plans who wouldn't have been able to, absent the law. But that number includes some who switched to their parents' plans from other coverage, Commonwealth Fund officials told the Los Angeles Times.

Check 6: A job killer?

Romney: "Obamacare is a job-killer."

The facts: The CBO estimated in 2010 that the law would reduce the amount of labor used in the economy by roughly half a percent.

But that's mostly because the law will give many the opportunity to retire, stay at home with family or switch to part-time work, since they can get health insurance more easily outside of their jobs. That voluntary retreat from the workforce, made possible by the law's benefits, is not the same as employers slashing jobs because of the law's costs, as Romney implies.

The law's penalties on employers who don't provide health insurance might cause some companies to hire fewer low-wage workers or to hire more part-timers instead of full-time employees, the budget office said. But the main consequence would still be from more people choosing not to work.

Apart from the budget office and other disinterested parties that study the law, each side uses research sponsored by interest groups, often slanted, to buttress its case. Romney cites a Chamber of Commerce online survey in which nearly three-quarters of respondents said the law would dampen their hiring.

The chamber strongly opposes the law, having run ads against it. Its poll was conducted unscientifically and is not a valid measure of business opinion.

More on the health-care debate, D 2-3

The state of care in Massachusetts Path murky for 30 million uninsured A tax, or penalty, or what? Q&A with ASU health-care expert

Massachusetts health law may bode well for federal law

Jul. 4, 2012 07:48 PM

Associated Press

BOSTON -- Massachusetts has the nation's highest rate of residents with health insurance. Visits to emergency rooms are beginning to ease. More residents are getting cancer screenings, and more women are making prenatal doctors' visits.

Still, one of the biggest challenges for the state lies ahead: reining in spiraling costs.

Six years after Gov. Mitt Romney signed the nation's most ambitious health-care law -- one that would lay the groundwork for his presidential opponent's national version -- supporters say the Massachusetts law holds promise for the long-term success of Barack Obama's plan.

Like the federal law it inspired, the Massachusetts law has multiple goals, among them expanding the number of insured residents, reducing emergency-room visits, penalizing those who can afford coverage but opt to remain uninsured, and requiring employers to offer coverage or pay a fine.

Supporters of the Massachusetts experiment are quick to point out its successes.

An additional 400,000 individuals have gained insurance since 2006, meaning about 98percent of residents have coverage.

A recent study by the Blue Cross Blue Shield of Massachusetts Foundation found that between 2006 and 2010, the use of emergency rooms for non-emergency reasons fell nearly 4percent. That was a key goal of the law, since using emergency rooms for routine care is far more expensive than visiting a doctor.

State health officials also point to what they say are increases in mammograms, colon-cancer screenings and prenatal-care visits and a 150,000-person reduction in the number of smokers after the state expanded coverage for smoking-cessation programs.

"Since Gov. Romney signed health-care reform here in Massachusetts, more private companies are offering health care to their employees, fewer people are getting primary care in an expensive emergency-room setting, and hundreds of thousands of our friends and neighbors have access to care," said Gov. Deval Patrick, a Democrat and co-chairman of Obama's re-election committee.

Another reason the law remains popular may be that so many Massachusetts residents receive insurance through work and have been largely untouched by its penalties. The Blue Cross Blue Shield study found 68percent of non-elderly adults received coverage through their employers in 2010, up from about 64percent in 2006.

The study also found no evidence to support one fear lawmakers had when they approved the law -- that employers or workers might drop coverage because of the availability of public coverage.

Another indication of the law's acceptance in Massachusetts is the reduction in the number of those assessed a tax penalty for failing to have insurance despite being able to afford it. In 2010, 44,000 Massachusetts tax filers were assessed the penalty under the "individual mandate." That's a drop from the 67,000 people required to pay the penalty in 2007, the first year it was assessed.

In 2010, the highest penalty was $93 a month, or $1,116 a year. In 2012, the highest penalty increased to $105 a month, or $1,260 a year.

Massachusetts is the only state with an individual mandate, although the Supreme Court last week upheld the constitutionality of a similar mandate in the federal law.

Despite the penalty, most polls place support for the initiative at more than 60percent, about double the approval rate for the federal health-care law.

Supporters say there's a lesson there, too. The more people begin to understand the benefits of the federal law, they say, the more support for the federal law should increase.

"The first lesson is that you can meet the goals we set out in Massachusetts, you can cover the majority of the uninsured and fix the broken market" for health care, said Jonathan Gruber, who helped craft both the state law and the federal law as an adviser to Romney and Obama.

"And you can do so with broad public support," Gruber said. "Based on what we've seen in Massachusetts, people like this."

Getting more people insured doesn't necessarily improve their access to care, however.

A survey last year by the Massachusetts Medical Society found long waits for appointments with primary-care doctors: an average of 48 days for an internist and 36 days for a physician of family medicine. More than half of primary-care doctors were no longer taking new patients, a slight increase from the previous year.

At the same time, since the law was approved in 2006, Massachusetts residents are more likely to have a place they usually go when they are sick or need advice (up 4.7 percent), more likely to have had a preventive-care visit (up 5.9percent), more likely to have had multiple doctor visits (up 5 percent) and more likely to have had a dental visit (up 5percent), the Blue Cross Blue Shield report found.

The charge that the law has been a "budget-buster" in Massachusetts has also been challenged.

A recent study by the business-backed Massachusetts Taxpayers Foundation found that during the five full fiscal years since it was implemented, the law has cost the state an additional $91 million a year after federal reimbursements -- well within initial projections.

The idea of exporting Massachusetts' law to the rest of the nation has its critics, too.

Josh Archambault, health-care policy director for the Pioneer Institute, a conservative-leaning Boston-based think tank, said a narrower approach would be better.

"There are many unintended consequences when Washington tries to design a policy that meets the very different needs of states as diverse as Massachusetts and, say, New Mexico," he said. "We need some specific federal actions to increase access to affordable health care, but the (federal law) went too far."

There's also at least one big cautionary note: Massachusetts still struggles to slow the spiraling cost of health care for residents.

This year both the Massachusetts House and Senate have approved bills aimed at trimming projected health-care costs in the state by $150 billion to $160 billion over the next 15 years. A committee is hoping to iron out the differences between the two bills before the end of the formal session July 31.

Gruber said the cost question shouldn't be used as a reason not to expand coverage. Gruber likened health-care expansion to a baby in its crib. "We're going to have to crawl before we can walk and run," he said. "To say the bill failed (because it didn't include cost controls) is to say we need to keep the baby penned up until it can run."

Mitt Romney flip flops & says Obamacare is a tax

Of course Mitt Romney was the inventor of Obamacare.

In it's original form Mitt Romney invented Obamacare which

was originally called Romneycare when he invented and passed it

as governor of Massachusetts.

They are both liars!!!!

Source

Massachusetts health law may bode well for federal law

Source

Not a tax, not a penalty, not a protection

Obamacare -- Lies, mistruths, falsehoods and fabrications

Source

Brown: Obamacare -- Lies, mistruths, falsehoods and fabrications

Posted: Saturday, July 7, 2012 7:10 pm

Guest commentary by Susan Stamper Brown

Legalization of something does not necessarily make it a good idea. It was once legal to own a slave. Democrats who voted against abolishing slavery in 1864, have been doing their part ever since to enslave Americans to one social program or another. Obamacare is just the latest example.

For years, Americans have been abundantly blessed with a mostly free-market health-care system in which competent physicians at state-of-the-art health-care facilities deliver the latest medical care. Yes, that care comes at a cost, but the alternative, which Obamacare will certainly create, is rationing.

Now that the Supreme Court deemed Obamacare's individual mandate for what it is -- a tax, Democrats are attempting to redefine it as a penalty. It's just their nature. Why call it a baby when you can reduce it to a fetus? Why bother worrying about illegal aliens when the term "undocumented workers" sounds so much more nebulous? I'll go halfway; let's call it a "penalty tax."

Lies, lies, and more lies.

No tax increases on the middle class: Has anyone noticed Democrats are always talking about strengthening the middle class, and yet almost all of their legislation ends up hurting it? It's the new "trickle down" theory. Take money from the top and sprinkle it over everyone else with no plan for growth. What you get is an increased lower class and a dwindling middle class. To make matters worse, Obama's administration keeps redefining down the definition of middle class.

President Obama pledged (his word, not mine) "No family making less than $250,000 a year will see any form of tax increase." Wall Street Journal's senior writer Stephen Moore claims almost 75 percent of Obamacare expenses will be funded by those making less than $120,000 annually.

Trying to get ahead by doing a little investing? Think again. Section 1411 of the law will levy a 3.8 percent "Medicare tax" on capital gains, dividends, rents and royalties. The plan also penalizes "Cadillac" insurance plan holders by charging a whopping 40 percent excise tax — unless they are part of the White House's chosen few who were given permission to opt out. Overall, Obamacare imposes 18 tax increases at a cost of $503 billion mostly funded by the middle class and the elderly via Medicare cuts.

In other words, there are no freebies that aren't paid for by the same middle class taxpayers Obama purports to defend. Odds are, many of you reading my column will be recipients of this broken promise.

Medicare will be protected: Well, not actually. Funding cuts of more than $500 billion, in addition to more than 150 new provisions, will affect quality care. Like any business, physicians cannot remain in practice when their profits don't keep pace with costs to do business. Obamacare will bleed them dry. It may not happen overnight, but rest assured, it will happen, and when it does, the government will be right there to fill the gap with government-run facilities. Ask veterans and their families how that's working out for them.

Medicare's patient-doctor relationship will be preserved: Much like the U.K.'s National Health Service (NHS), Obamacare is more about cost control than quality care. The NHS determines medical needs based upon a calculation created by economists, and uses it to determine who does or does not receive treatment. We're not there yet, but Obamacare pushes us in that direction. Baby steps. And former Congressman Alan Grayson (D-FL) had the audacity to suggest the Republican vision for health care boils down to letting people die. Physician heal thyself!

Obamacare will not add to the deficit: Democrats' pants should be on fire for this promise. Research done by experts at the Heritage Foundation reveals Obamacare is "a trillion-dollar budget buster" and claims Democrats rigged their numbers using "budget gimmicks, sleights of hand, accounting tricks, and completely implausible assumptions."

One of the greatest things about America is that we have the opportunity to right our wrongs by way of the ballot box. What the Supreme Court declared as constitutional voters can declare as history come November.

Susan Stamper Brown is an opinion page columnist, motivational speaker and military advocate who writes about politics, the military, the economy and culture. E-mail Susan at writestamper@gmail.com or her website at susanstamperbrown.com.

xxx

Source

xxx

Source

xxx

Source